Auto Insurance in and around Chicago

The first choice in car insurance for the Chicago area.

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

Here When The Unexpected Arrives

State Farm isn't afraid of the unexpected, and with our great coverage, you don't have to be either. With various options for coverage and savings, you can be sure to choose a policy that fits your distinctive needs.

The first choice in car insurance for the Chicago area.

Insurance that won't drive you up a wall

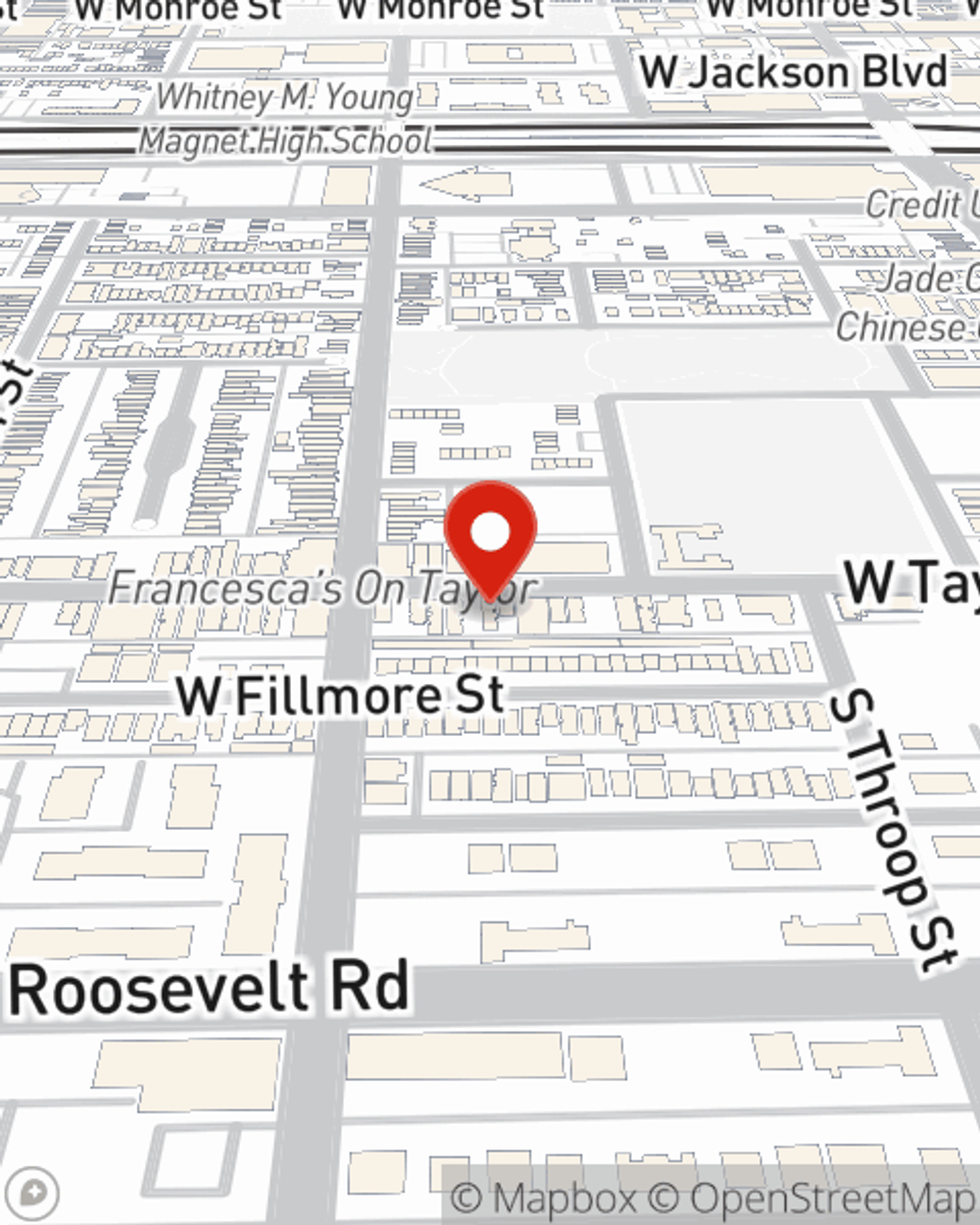

Agent Dwayne Jackson, At Your Service

You need State Farm auto insurance, the insurer trusted by 44 million U.S. drivers. When the unexpected finds you, State Farm is there to get you moving again! Agent Dwayne Jackson has the dedication and competence you need when unfortunate incidents cross your path.

Don’t let bad luck cause a hold up! Visit State Farm Agent Dwayne Jackson today and see which coverage fits your needs with State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Dwayne at (312) 455-0675 or visit our FAQ page.

Simple Insights®

Times to review your insurance

Times to review your insurance

Consider completing an insurance review to confirm that you, your family, home, car and property are insured.

How to sell a motorcycle

How to sell a motorcycle

Whether you're selling a motorcycle now or perhaps you're just thinking about it, here are some tips that can help when you're ready to sell your motorcycle.

Dwayne Jackson

State Farm® Insurance AgentSimple Insights®

Times to review your insurance

Times to review your insurance

Consider completing an insurance review to confirm that you, your family, home, car and property are insured.

How to sell a motorcycle

How to sell a motorcycle

Whether you're selling a motorcycle now or perhaps you're just thinking about it, here are some tips that can help when you're ready to sell your motorcycle.